How to set up a HMRC Government Gateway Account

Trusted by entrepreneurs worldwide, Icon Offices makes UK company formation seamless. Start your business now for just £43.99!

You can set up a Government Gateway account yourselfin less than 2 minutes.

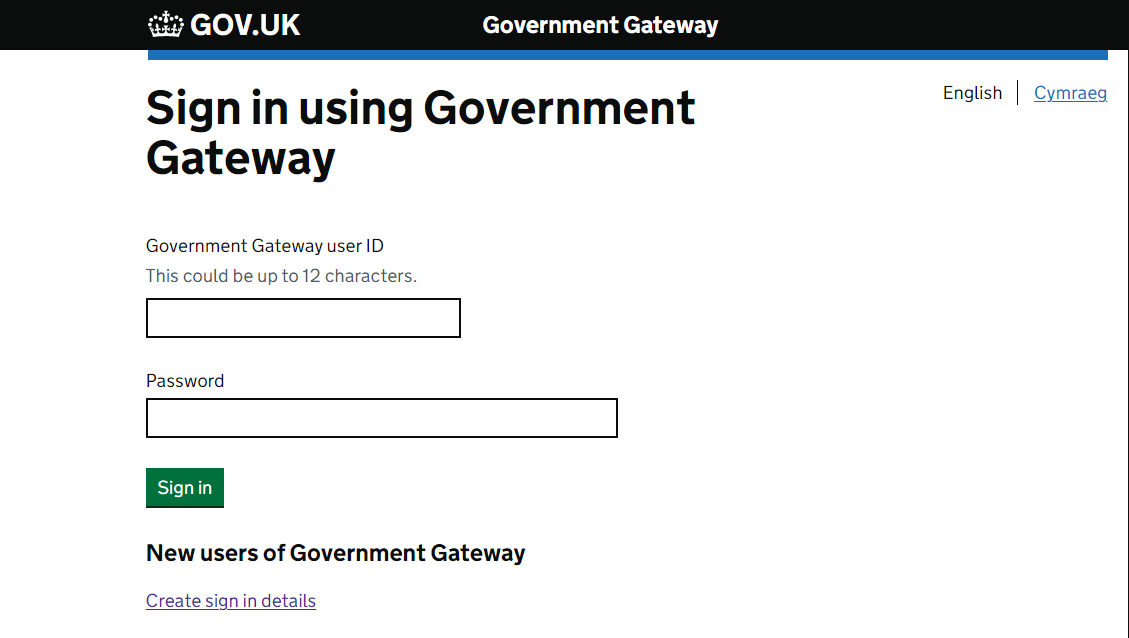

Government Gateway account creation

Create a Government Gateway account here https://www.gov.uk/log-in-register-hmrc-online-services

1) Enter your email address.

2) Confirm your email address, enter your full nameand create a password.

The password should be of 10 or more characters andit can be a combination of letters, numbers or symbols.

3) A Government Gateway user ID will be created.

You will also receive an email on the registeredemail address with the Government Gateway user ID.

You will need your user ID and your password eachtime you sign in to Government Gateway. Hence keep it safe!

After creating the Government Gateway User ID, youneed to login again on the same page and set up additional security using your phonenumber.

You can select one of the following options to receive codes:

a) Textmessage > Get codes sent to a mobile phone (UK or a Non-UK mobile number)

b) Voicecall > Get codes by automated message to a UK mobile or landline.

c) Authenticatorapp for a smartphone or tablet > Get codes generated by an authenticator appon your mobile device such as a smartphone or tablet.

Every time you login to the HMRC online services,you need to verify yourself via a 2 stepauthentication system.

Manage a tax, duty or scheme

To manage a tax, duty or scheme, you must add a tax to yourbusiness tax account.

The “Help and Contact” section on the Home pagegives you step by step instructions on how to add Corporation Tax, PAYE, SelfAssessment, VAT and Other taxes or schemes etc.

Activation of Corporation Tax

a) Process to activate Corporation Tax fora newly registered company incorporated less than 1 month ago.

To activate corporation tax, you need a UTR number andActivation code.

They are usually sent within 2 weeks after thecompany is formed.

b) Process to activate Corporation Tax fora company registered more than 30 days ago.

If you do not have the UTR number, simply order ithere: https://www.tax.service.gov.uk/ask-for-copy-of-your-corporation-tax-utr?_ga=2.218680222.668899684.1680331783-1933168306.1675360745

Once received, you can enter the UTR number and yourcompany number to request for an activation code. The activation code is then sentto the company’s registered address

You'll receive an activation code in the post within 7 days. Enteryour activation code into your Government Gateway account and your corporationtax account will be activated.

UTR number:

It is a 10 digit number sent by HMRC and ismentioned on most letters sent by HRMC.

Activation Code:

It is a 12 digit number sent by HMRC and is onlyvalid for 28 days from the date of the activation code letter.

Managing your HMRC Government Gateway Account

You can easily change your account details like the password, emailaddress etc from the “Manage Account” section.

Afterlogging in click on – “Manage Your Government Gateway.”

Team meIcomber account access

You can give permission to your team members or even an Accountantto access your business tax account.

Simply go to ‘Manage account’ once you login to the GG account andadd the details of the team members. You can edit the details and delete themembers whenever required.

Messages

All important messages from HMRC are delivered to the Gateway Account.